On Tuesday 23rd May 2017, the Nederlandse Financierings-Maatschappij voor Ontwikkelingslanden N.V. (FMO), the international development bank of the Netherlands rated AAA (stable) by S&P and AAA (stable) by Fitch, successfully priced its third EUR Sustainability Bond, a 6-year EUR 500 million RegS transaction.

The proceeds of the Sustainability Bond support the financing of Green and Inclusive Finance Projects according to FMO’s Sustainability Bonds framework, which is aligned with FMO’s long-term strategy of inclusive and green growth. Projects to be financed include climate change mitigation (renewable energy and energy efficiency) and climate change adaptation, as well as inclusive finance projects (microfinance and SME financing).

Given the strategic nature of this Sustainability Bond issuance, FMO announced on 9thMay 2017 their intention to hold a series of European investor meetings and a conference call prior to the issuance of a 4-6 year Sustainability Bond.

- Following the collection of investor feedback and on the back of a receptive Euro market with no significant competing supply, the transaction was announced on Monday 22nd May 2017 with Initial Pricing Thoughts (“IPTs”) of MS-low/mid teens for a EUR 500mn no-grow 6-year Sustainability Bond.

- Books officially opened the following morning at 08.15am London time with guidance of MS-13 area. Within 45 minutes of book opening, orders stood in excess of EUR 800mn, prompting the issuer to revise guidance to MS-14 area.

- The positive momentum continued, pushing book size to over EUR 1.2bn by 10.00am London time, leading to another revised guidance to MS-15/-16 Will Price In Range. Shortly afterwards, the spread was set at MS-16bps and books were closed by 10.20am London time.

- The transaction was priced around 1.50pm London time with a coupon of 0.125% (ann.), giving a yield of 0.191% (ann.) and a spread of 35.8bps over the May 2023 Bund, offering an attractive pick-up versus the benchmark and a positive yield for investors.

Distribution

- Over 50 investors were involved, highlighting the strong following from FMO’s international investor base as well as broad support from the Green investor community, with participation from sustainable investors such as ACTIAM N.V., Alecta, APG Asset Management, Eurizon Capital Sgr Milano, Intesa Sanpaolo Spa Milano, PGGM on behalf of its clients, Storebrand AM and Union Investment (total sustainable investors estimated at 65%).

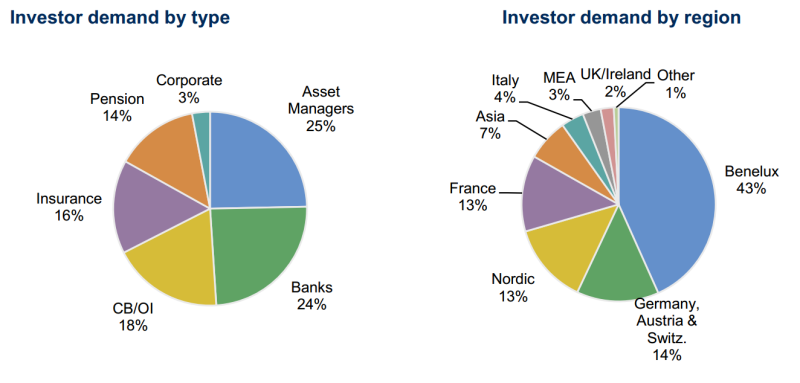

- Allocation was dominated by European investors (90%) with the largest proportion (43%) going to Benelux, followed by Germany / Austria / Switzerland at 14%. The Nordic and French investors were not far behind at 13% of allocations each.

- The deal attracted a diverse range of investor types, led by asset managers (25%) and banks (24%); the remaining half was represented by central banks / official institutions (18%), insurance (16%) and pension funds (14%).

Credit Agricole CIB, HSBC, J.P. Morgan and Rabobank acted as joint-bookrunners on this Euro Sustainability Bond transaction.