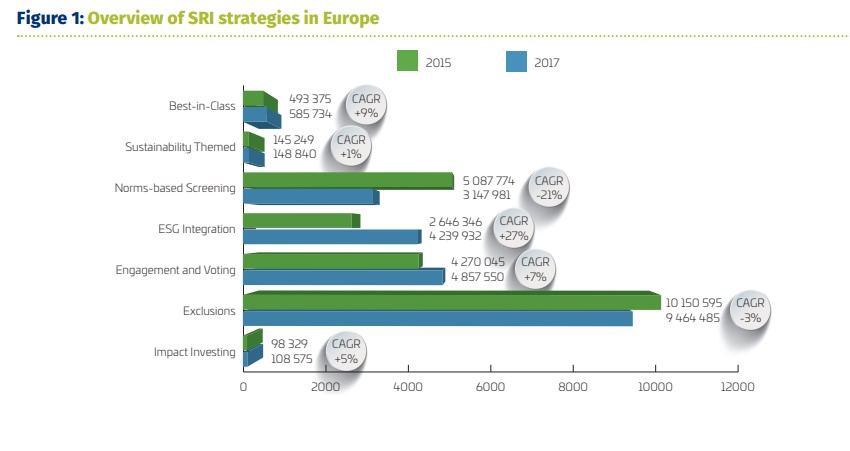

The 8th edition of Eurosif Market Study is finally here. The biennial Study reveals sustained growth for most sustainable and responsible investment (SRI) strategies. The past two years show clear signs of SRI becoming integral to European fund management with managers better articulating their investment strategies. ESG integration remains by far the preferred strategy, growing by 60%.

This is a very positive record, marked at over €4 trillion of assets under management, which indicates that almost every asset manager that responded to the survey implements some form of ESG integration. Engagement and Voting gains further ground as the strategy grows by 14% giving evidence of the renewed commitment of investors to interface with the companies in their portfolios and truly reach out to make a difference. This positive engagement translates into less appetite for more dogmatic approaches.

In fact, though Exclusions remains a dominant strategy in terms of assets with €9.4 trillion, Eurosif registers a slight decrease by 7%. Tobacco features as the most popular exclusion criteria, reflecting a wave of divestment which in the past two years has involved large asset owners from Europe and beyond.

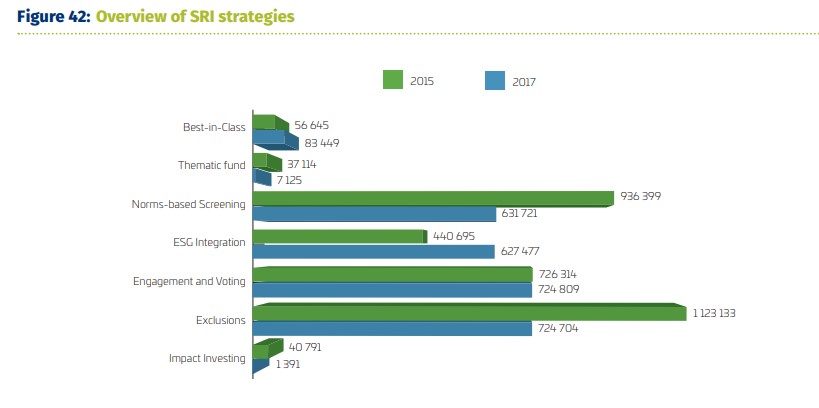

Impact Investing continues to grow registering a 6-year CAGR of 52% and reaching €108 billion in assets, from only €20 billion in 2013. Eurosif is bound to see more growth for this strategy in the next years, as it becomes increasingly aligned with Sustainable Development Goals (SDGs): a turnkey for investors. Another interesting trend Eurosif registers is the growth in the retail sector which goes from 3.4% of assets surveyed in 2014 to 30% this year. The appetite for SRI is clearly there, what is needed now is further work to capitalise on this wave of interest and with the latest policy dynamics we seem to be heading in the right direction.

This 2018 SRI Study represents for Eurosif a new beginning. In support of the European policy changes on sustainable finance of the last two years, which promise to change the financial sector fundamentally, Eurosif presents its landmark publication as a manifesto in support of the Action Plan on Sustainable Finance. Also, and for the first time, Eurosif has collaborated with academic partners for the preparation of this work, as another step towards further streamlining its methodological approach to gather SRI investment flows across Europe.

In the 2016 Study Eurosif described the inception of those meaningful policy signs which led to the tsunami we have witnessed in the past two years. Giving further impetus to actions at country level, the European agenda in Sustainable Finance has set in motion a series of changes which Eurosif expect to be cemented into the financial system. Sustainable and Responsible Investment, as a main pillar of Sustainable Finance, is destined to become part of the way both institutional and retail clients invest their money.

The European Action Plan has clearly determined that Sustainable Finance is here to stay and SRI will continue to help shape and mainstream this positive current in a relevant and structural fashion. The next step for Europe and the industry is to gain consensus around what are the criteria that define sustainable and responsible investing, to ensure a transparent level playing field to support future growth.