Bron

ACATIS

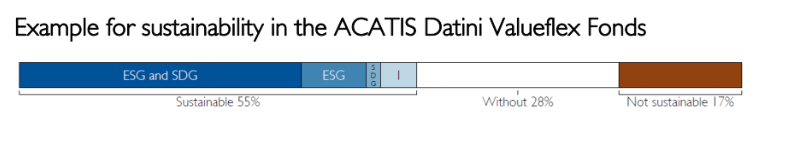

Sustainability and transparency go hand in hand. Effective immediately, the monthly reports prepared by ACATIS Investment KVG mbH will show the percentage of investments that are sustainable, as well as the extent to which they meet the sustainability requirement. With this step, ACATIS wants to take the lead and show investors what percentage of a particular fund’s AUM is invested in good companies/countries, or those that are progressing well in that direction. Over the next few years, the focus on sustainability will continue to increase and affect investor behaviour. Using a bar chart, ACATIS provides investors with a guide that shows the extent to which each fund meets the sustainability criteria.

What becomes evident is that even “normal” funds hold a high percentage of sustainable investments. ACATIS uses six classification categories:

- ESG and SDG criteria: dark blue field

- ESG criteria only: blue field

- SDG criteria only: light blue field

- Individual rating: very light blue field

- No rating: white field

- Not sustainable: brown field

The ethical/sustainable assessment of companies is often divided into three areas environment, social and governance. An ESG assessment estimates how a company currently operates in the three different areas.

The SDG criteria (Sustainable Development Goals) were established by the United Nations as globally applicable priorities and targets until the year 2030. A total of 193 countries have agreed on 17 targets and 169 sub-targets that are supposed to be implemented by 2030. They combine ecological, social and economic objectives and therefore cover all of the dimensions of sustainability. The first objective is the global fight against poverty. This includes the fight against hunger and universal access to clean water.

Titles are analysed on the basis of the ACATIS Fair Value sustainability approach, the criteria for which ACATIS developed ten years ago with its clients, and which have been steadily expanded and refined since that time. For example, the SDGs were incorporated as an additional filter in 2019. It checks whether a company – through its products and services – makes a positive contribution to the future and towards achieving the SDGs, and which SDGs the contribution can be allocated to.

The ACATIS classification uses three categories for ESG and SDG:

- Companies that only have a positive ESG score, which also includes “positive” countries

- Companies that only contribute to the SDGs

- And companies with positive ESG and SDG targets.

Titles with special ratings are labelled “Individual rating”. This special rating is prepared especially for ACATIS Fair Value Investment AG by the independent rating agency imug/Vigeo/Eiris according to the ACATIS Fair Value criteria. Titles without ratings, or cash positions, are shown under “No rating”. Titles and countries that breach the exclusion criteria or that are excluded from ACATIS Fair Value due to a negative ESG score or lack of contribution to the SDGs are classified “Not sustainable”.

Pure sustainability funds at ACATIS consist of the funds that carry the designation “ACATIS Fair Value” in their title. In the stock category, this includes ACATIS Fair Value Aktien Global, and there is also ACATIS Fair Value Modulor Vermögensverwaltungsfonds, which was launched as a balanced fund. Special agency RenditeWerk recently awarded the fund second place as the endowment fund of the year 2020. The RenditeWerk editors were impressed with the fund’s strict sustainability approach and its distribution ratios. ACATIS Fair Value Bonds is a sustainable bond fund.

All three ACATIS Fair Value funds have received the FNG 2020 seal of approval (one star out of three) that is awarded by the Forum Nachhaltige Geldanlagen (FNG). This means that the funds follow an especially demanding and comprehensive sustainability strategy, and they receive additional bonus points for institutional credibility, product standards and selection/dialogue strategies.