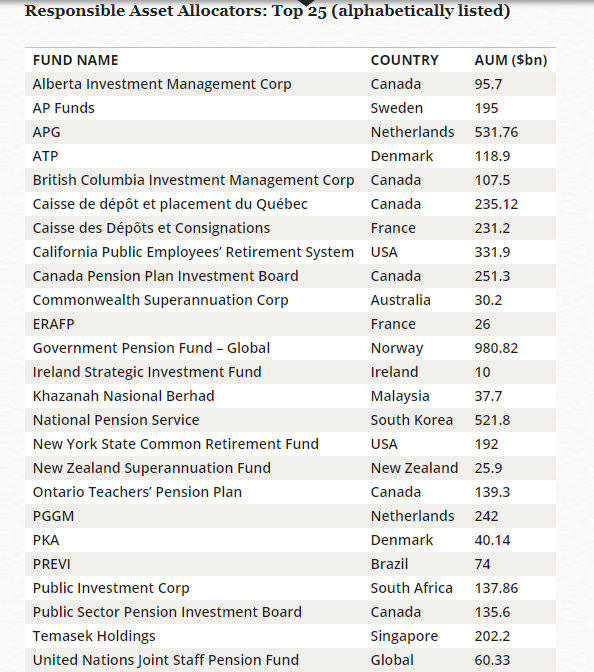

De Amerikaanse denktank en burgerbeweging New America heeft de zogenaamde ‘Bretton Wood II Leaders List’ gepubliceerd van ‘most responsible’ investors/asset owners in de wereld. De Nederlandse pensioenbeheerders APG en PGGM prijken op deze zeer selectieve lijst van 25.

Over de lijst (engels):

The BWII Leaders List was developed through a rigorous analytic process. After reviewing a master list of 298 asset allocators, 228 SWF and GPF, representing over $20 trillion in assets under management (AUM,) were selected for careful examination. Eliminating sub-managed accounts and duplicates, the list was further honed to 207 funds. This group was then screened for availability of information, minimum size of assets and investment activity, resulting in a final list of 121 SWF and GPF, comprising $15 trillion in AUM. Each of the 121 asset allocators was rated against the core Principles and Criteria by 2-3 independent expert reviewers. Scores were then double-checked and cross referenced by a senior expert, and outliers were subjected to further review. Finally, the top 25 highest scoring SWF and GPF were selected for the BWII Leaders List: the 25 Most Responsible Asset Allocators.

The Leaders List is an exceptional group, including seven SWF and 18 GPF comprising $4.9 trillion in combined AUM, and individual funds ranging from $10 billion to $1 trillion in assets. To put this into context, the combined asset base of this group is larger than the GDP of every country but the United States and China. The 25 funds on the list come from 15 different nations and one global organization. Canada, with six funds in the top 25, has the highest representation, but the leaders list is diversified, spanning six continents and including funds from Brazil, Korea and South Africa. The leaders were selected for their high scores, but they also standout for their high conviction in responsible investing, their belief that ESG is material to long-term returns and their initiative to get ahead of the curve. The leaders are constantly looking for ways to improve and deepen their responsible investing programs and they are committed to learning from peers and sharing their insights.