Bron

S&P Global

Investors’ growing appetite for sustainable investment vehicles is paying off, even as lingering doubts about the strategies persist for regulators and some asset managers.

Since their introduction more than a decade ago, environmental, social and governance-focused investment products have now begun recording returns on par with or better than funds built purely for risk-weighted performance, a trend that runs counter to the notion that taking ESG into account means leaving money on the table.

Those performance-tied concerns were underscored by the U.S. Department of Labor in April when the agency warned investment advisers working on certain retirement plans that they “must not too readily” place ESG factors above economic returns, given their obligations to act in their clients’ best interests. As a result, certain asset managers have grown worried that by creating ESG-focused investment strategies, they could be setting themselves on a collision course with regulators.

“[ESG] can be a pretty wide definition,” Baird Equity Asset Management Director Reik Read said in an interview. “If we’re focusing on one of these [categories], are we getting the returns that the clients want?”

First designed for individual investors looking to craft portfolios around their personal beliefs, sustainable investing has blossomed into a $22.8 trillion global industry with 84% of asset owners around the world currently weighing or already pursuing sustainable investments, according to a recent report from the Morgan Stanley Institute for Sustainable Investing and Morgan Stanley Investment Management Inc.

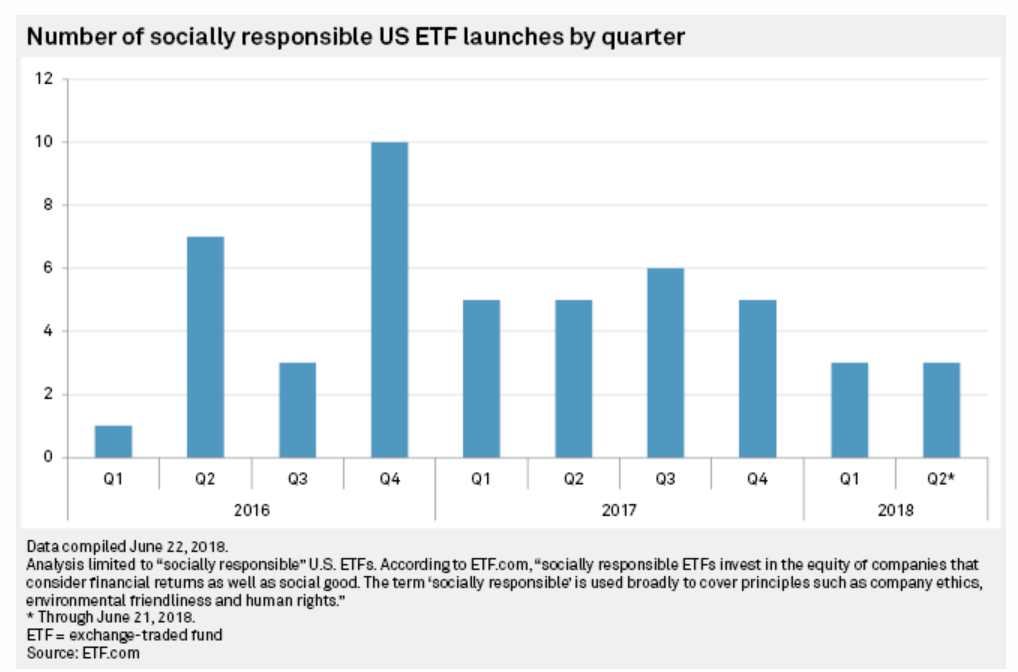

Returns from ESG-focused exchange-traded funds and mutual funds have also swelled, overtaking broader funds’ median returns.

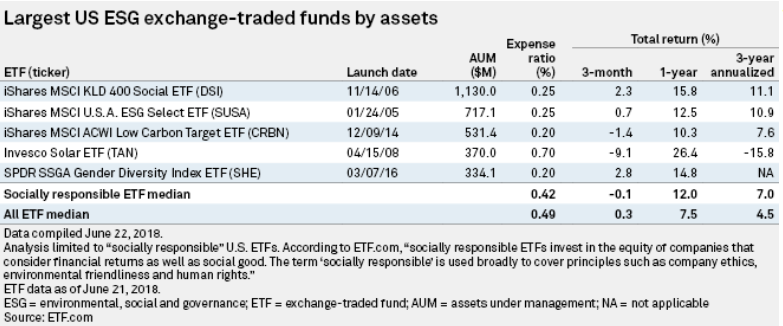

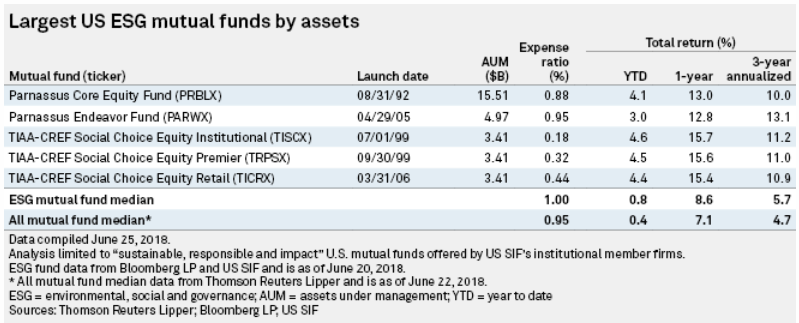

ESG-focused mutual funds in the U.S. are no different. The median total returns for such funds were 8.6% for the year leading up to June 20 and 5.7%, on an annualized basis, for the three years ended June 20, according to an S&P Global Market Intelligence analysis of Bloomberg LP data published by the U.S. Forum for Sustainable and Responsible Investment. That compares with median returns for all mutual funds of 7.1% for the one year leading up to June 22 and 4.7%, on an annualized basis, for the three years ended June 22, according to Thomson Reuters Corp. data.While the values of socially responsible ETFs declined in the three-month period ended June 21, those funds have broadly seen long-term gains. The median total return for ESG-focused ETFs was 12% for the one year leading up to June 21, according to ETF.com. In comparison, the total median return for all ETFs in the same period was 7.5%. Socially responsible ETFs also tend to cost less than most ETFs.

Sustainable funds have partially seen higher returns due to the “nice tailwind” entwined in their structures: heavily weighted technology stocks, CFRA Senior Director of ETF and mutual fund research Todd Rosenbluth said in an interview. Technology stocks have grown rapidly for several years now, aiding the growth of sustainability funds, which typically weight such companies more heavily than companies in sectors like energy and utilities, Rosenbluth said.

Institutional investors such as BlackRock Inc., Vanguard Group Inc. and State Street Global Advisors Inc. have driven sustainable investing efforts in the U.S. for years now by using their dominant ownership positions to sway companies’ decisions on topics like climate change, gender equality and gun control.Those returns are part of the reason why money managers, big and small, are leaping into the ESG movement.

Now, smaller U.S. companies and investors — millennials, endowment and pension fund managers and women on Wall Street, among others — are joining the ESG crusade.

“This [is] an incredibly rich new frontier, and one that is probably the single greatest growth opportunity. Not only as a practice, but as an industry,” said Kristina Van Liew, a managing director of Morgan Stanley’s independent institutional consulting division, Graystone Consulting, at the Morningstar Investment Conference on June 13.

Yet skepticism over the long-term viability and regulatory landscape of ESG-focused funds still exists in some parts of the asset management realm.

Certain market participants have grown concerned that the Labor Department’s April guidance may create a “chilling effect” that could deter some advisers from considering ESG factors when working with a client, according to a U.S. Government Accountability Office report, which also urged the Labor Department to provide additional guidance around sustainable investing.

“[The regulators] need to start taking the lead to say, ‘From our standpoint, here’s what this means and here’s what it doesn’t mean,'” Baird’s Read said.