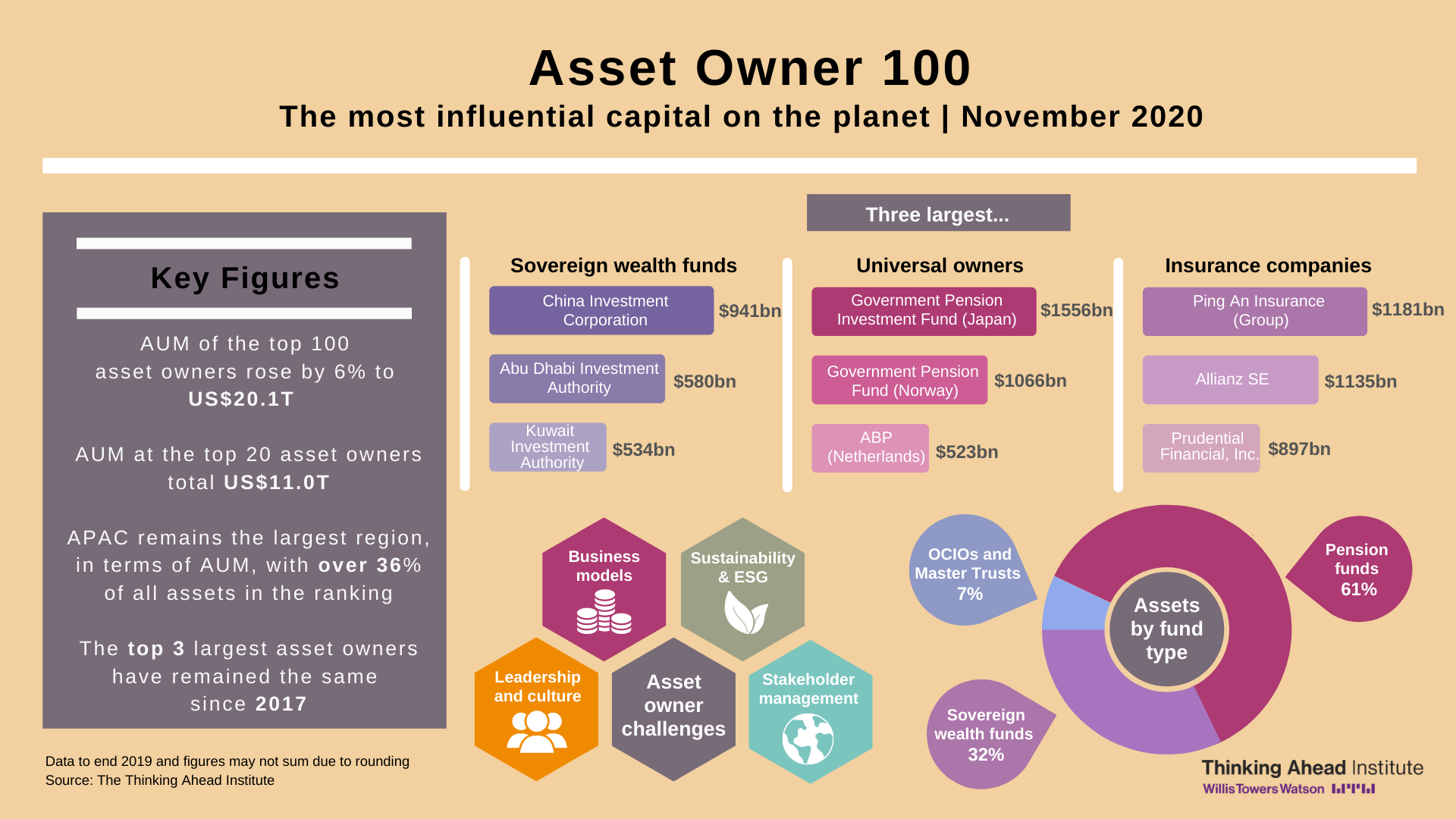

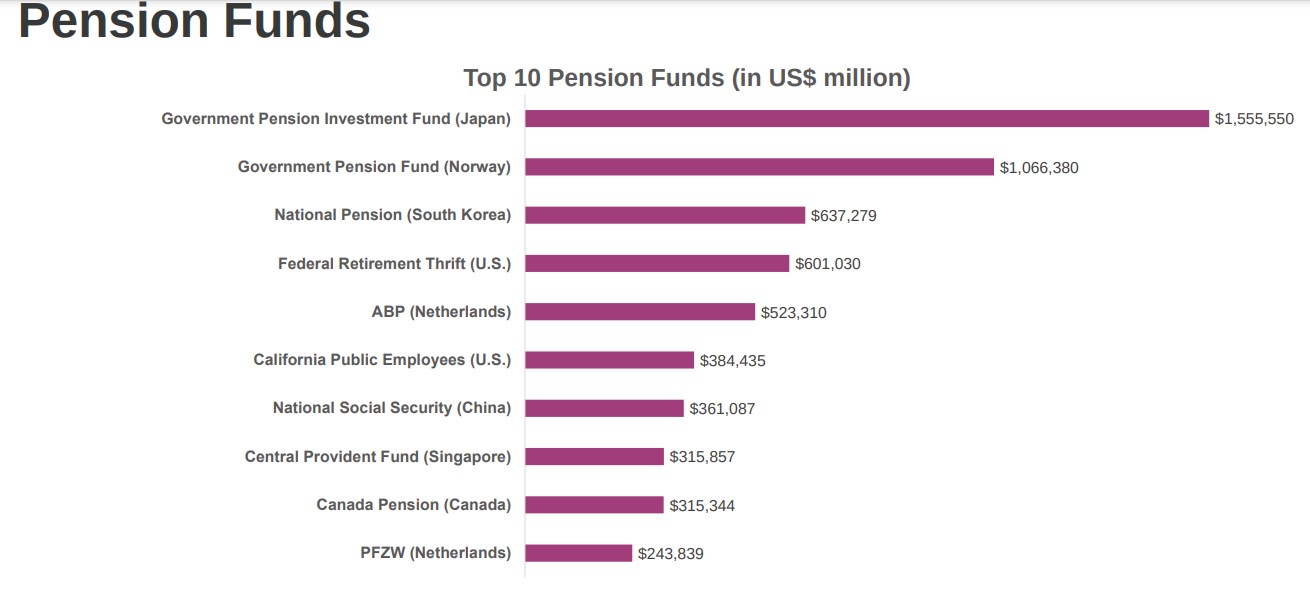

The Asset Owner 100 (AO100) – the world’s 100 largest asset owners grew by 6% last year to reach over US$20 trillion, according to research from the Thinking Ahead Institute (TAI). Pension funds remain the single biggest group of asset owners accounting for over 60% of assets, followed by sovereign wealth funds (32%) and Outsourced Chief Investment Officers (OCIOs) and Master Trusts combined (7%). According to the research, the AO100 have become more prominent in integrating ESG and being more active owners, including aiming for real-world impacts in their investment strategies.

Roger Urwin, co-founder of the Thinking Ahead Institute, said: “With responsibility for over one third of all asset owner capital globally, the AO100’s influence on other investors and society is growing and becoming more important.”

According to the research, the AO100 have become more prominent in integrating ESG and being more active owners, including aiming for real-world impacts in their investment strategies. These strategies increasingly include new elements, such as: factoring in member views; adopting new investment benchmarks; reporting on the impacts of their investment strategies (via the TCFD framework and the SDGs); reducing carbon emissions from portfolio holdings and investing in assets that will support the transition towards a low-carbon economy; and devising and implementing climate transition strategies that align with the Paris Agreement.

Roger Urwin said: “At the larger end of the AO100, funds are pursuing so-called universal owner strategies which contribute to safeguarding the financial system and addressing other systemic risks, including climate change, without sacrificing risk-adjusted returns. This is consistent with a new era of ESG – which we call ESG 3.0 – that is fundamentally different from previous versions in that it includes real-world impacts on the environment and society, while delivering better outcomes for beneficiaries.”

The research indicates that universal owner strategies are highly collaborative and involve working through industry groups, such as the Principles for Responsible Investment (PRI) and Net-Zero Asset Owner Alliance, and improve long-term financial outcomes, through beta (market return) rather than alpha (securities relative return).

Roger Urwin said: “Increasing numbers of the AO100 are following nation states and corporations in declaring their intention to align with the Paris Agreement and be net-zero by 2050, via their investment portfolios. This is an ambitious goal and will require new types of investment mandates that explicitly incorporate a third dimension of investment after risk and return: impact. These three-dimensional mandates (3-D mandates) will, of necessity, have to be highly innovative portfolios and engagement strategies if they are to deliver a combination of real-world impacts and improved portfolio outcomes.”

The research also highlights other current asset owner challenges, which include:

- Resetting their purpose, mission and vision and consequent changes to strategy and culture

- Streamlining governance arrangements particularly in delegations, partnering and processes

- Developing a strong access route and strategy to investing in mainland Chinese assets.

“The core idea of a universal owner is a large institution investing long-term in widely diversified holdings across multiple industries and asset classes, and adapting its investment strategy to these circumstances. For universal owners, overall economic performance will influence the future value of their portfolios more than the performance of individual companies or sectors. This suggests that universal owners will support the goals of sustainable growth and well-functioning financial markets. A universal owner will also view these goals holistically and seek ways to reduce the company levelexternalities that produce economy-wide efficiency losses.”

Download the research report (pdf)