Engagement forms one of the pillars of NN IP’s issuer assessment and governance and is a key part of our green bond investment process. We meet regularly with all the issuers in portfolio, both on broader ESG topics and on specifics relating to their green bond frameworks and their environmental risks and strategies. Engagement also enables us to advise current and prospective issuers on how to further enhance their sustainability. We start the dialogue prior to a bond’s issuance and focus on building up a mutually beneficial relationship with the issuer. They offer us insights on their business and strategy; we can inform them on best practice and what investors are looking for.

Dialogue mitigates risk of greenwashing

Entering and maintaining an active dialogue is an important part of our overall assessment of an entity – corporate, government or supranational – and its bonds. It helps us learn more about an issuer and its sustainable strategy. Greenwashing is a significant risk for investors who want to make a clear positive impact and avoid reputational damage. This risk is due to the self-labelling of green bonds and the fact that issuers voluntarily report on their contribution to climate change. Engagement is an important tool in mitigating this risk. Regular contact gives us a better understanding of the issuer and the individual bond issue and helps ensure we do not invest in entities that are not as “green” as they might first appear to be.

Pre-issuance engagement

NN IP’s green bond team engages with almost every issuer that we are potentially interested in adding to the portfolio at pre-issuance stage. This is to ensure we gain a complete picture of the issuer – their core business activities and sustainability strategy – and have sufficient information to carry out a bond-level assessment. An increasing number of issuers also contact us before the issuance stage, when they are still putting together their green bond framework. This trend has been strengthened by the increased regulation, especially in the Eurozone, and the introduction of the EU Taxonomy. Engagement also enables us to advise current and prospective issuers on the best market practices to further enhance their sustainability and improve reporting. Such guidance can relate to improving the governance process for the selection of eligible projects and setting the selection criteria thresholds for each category of use of proceeds.

Following up on use of proceeds and impact

We maintain a dialogue with most of the issuers in whose bonds we are invested and the green and non-green bonds in our database. We also engage with non-green issuers to help them improve their green bond frameworks and meet our strict standards. We specifically target issuers when we have questions on their annual allocation and impact report. These discussions help ensure transparency on how the proceeds are being allocated and that the quality of reporting meets expectations. We are also engaging more frequently with issuers on the information required to carry out the EU Taxonomy alignment exercise, as many are not yet able to perform this assessment themselves. This is another area where we can help them better prepare for the more strictly regulated environment for sustainable investments that is to come.

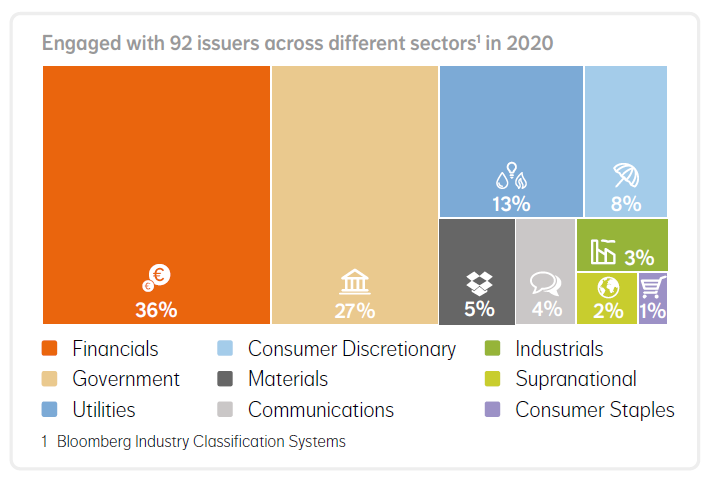

Engagement – 2020 in numbers

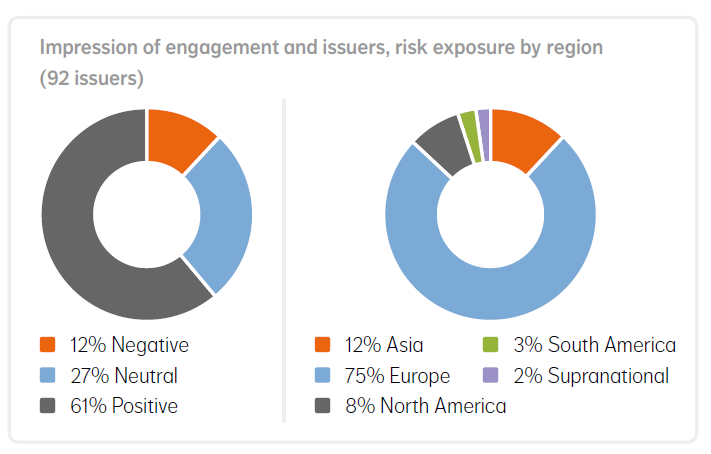

We had 97 engagement dialogues with 92 issuers in 2020. These took place either in face-to-face meetings, video calls or via email. Our engagement efforts cover the full range of issuer types. In 2020, we engaged with nine sovereign issuers, 34 government-related issuers and 49 corporate issuers. We carried out fewer engagement activities in the first quarter of the year with the outbreak of the Covid-19 pandemic and resulting market unrest, but this picked up again in the second half of 2020. In 2020, 61% of our engagement discussions left us with a positive impression. The total number of positive impressions was down slightly from 2019 due to more stringent sustainability regulations and the increase in non-European issuers. This figure represents the percentage of issuers with a credible green bond framework and sound company-level transition plan, and was also transparent and open to communicating with us.

Figure 1: NN IP engaged with 92 issuers in 2020

Source: Bloomberg

Source: Bloomberg

Figure 2: Impression of engagement, issuers/risk exposure by region

Source: NN Investment Partners

Source: NN Investment Partners

Stricter regulation and greater demands from investors are raising the bar for issuers, making the goals set for engagement increasingly challenging. At the same time, the number of green bond issuers from North America and Asia is picking up and their sustainability ambitions still lag those of their European peers. Still, the average quality of the dialogues by which we were positively impressed is rising. This reflects increased efforts to integrate sustainability more fully and improve transparency in terms of reporting and disclosure.

The NN IP approach: top-down engagement, bottom-up dialogue

In our top-down engagement, NN IP’s Responsible Investing team focuses on specific ESG targets in two ways. The first is controversy engagement, where we focus on companies that severely and structurally breach our norms-based criteria in the areas of governance, human rights, labour, environment, and bribery and corruption. The second is thematic engagement, which addresses chosen themes that have a material impact on society, and where we believe our engagement efforts can achieve beneficial change. Our current environment-related engagement themes focus on utilities, oil & gas and deforestation, areas also targeted by green bond-financed projects. In addition to these two top-down approaches, our analysts and portfolio managers maintain regular bottom-up dialogues with investee companies on ESG subjects we believe have a material impact on their value.

Bram Bos, Lead Portfolio Manager Green Bond NN Investment Partners