With just one week to go until the implementation of the first phase of SFDR, financial market participants are scrambling to prepare. But this is just the beginning. What implications will the Sustainable Finance Disclosure Regulation have for the financial playing field in Europe? NN IP recently hosted a webinar to highlight these developments and to start a discussion with clients. Here are just a handful of their many and varied questions.

SFDR is just one part of the EU’s Sustainable Finance Action Plan to redirect capital flows towards sustainable investments. The resulting framework of regulations aims to streamline the criteria financial market participants use to define, measure and report on the sustainability attributes of economic activities. The plan outlines ten reforms in three areas, namely, reorienting capital flows towards sustainable investment, mainstreaming sustainability into risk management and fostering transparency and long-termism in financial and economic activity. SFDR focuses on disclosures relating to sustainable investments and sustainability risks.

1. What are the timelines for implementation and the differences between the first phase and second phases?

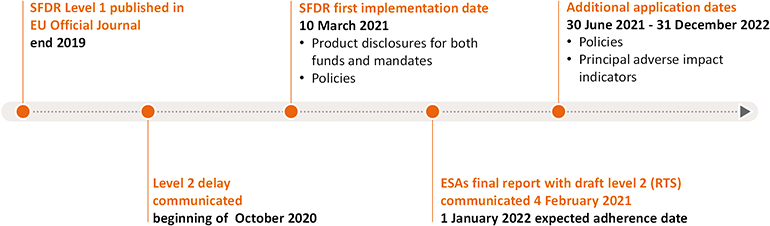

The implementation of SFDR is expected to run from 10 March 2021 until at least the end of 2022.

During the first phase market participants are required to implement SFDR level 1 legislation. This legislation lays down definitions to classify investment funds and mandates into three categories that reflect the level of transparency with regards to the sustainability of investments. These parties also need to adjust their documentation, marketing materials, website and reporting to reflect this. The SFDR level 1 legislation is final and will become applicable on 10 March 2021.

During the first phase market participants are required to implement SFDR level 1 legislation. This legislation lays down definitions to classify investment funds and mandates into three categories that reflect the level of transparency with regards to the sustainability of investments. These parties also need to adjust their documentation, marketing materials, website and reporting to reflect this. The SFDR level 1 legislation is final and will become applicable on 10 March 2021.

In the second phase market participants are required to implement SFDR level 2 legislation. This provides more details on the content, methodologies and presentation of disclosures set out in SFDR Level 1, for example climate-related metrics or metrics concerning human rights. The European Supervisory Authorities’ (ESAs) final report with the draft level 2 requirements (Regulatory Technical Standards or RTS) was published on 4 February 2021 and is expected to be endorsed and subsequently implemented on 1 January 2022.

2. Are there different requirements in SFDR for asset managers like NN IP and asset owners like pension funds?

From a high-level perspective, SFDR sets out requirements based on the products you offer or the services you provide. These result in definitions of either financial market participant – like manufacturers of pension products and fund managers – or financial advisor. There are some differences but the overall requirements are the same. However, we expect there to be differences in the interpretation and implementation of these requirements due to the different nature of these organizations.

3. What are the differences between the Article 6, 8, and 9 classifications?

In essence the classification says something about the level of integration of sustainability in our funds. At NN IP we have prepared a classification methodology using the legal requirements, classified the funds and prepared the required disclosures based on the classification.

Article 6 of SFDR focuses on the question of whether or not sustainability risks will be taken into account when making investment decisions and the rationale behind this. Based on what the legislation currently stipulates, our interpretation is that funds that are classified as Article 6 may not use the terms “ESG” or “sustainability” in their name, nor may they be promoted as being sustainable. There are however still a lot of questions on the naming and what constitutes promotion. In January of this year, the ESAs sent a letter to the European Commission incorporating these questions. We are of the opinion that guidance on these matters may be beneficial for the market.

The requirements for Article 8 go a step further. In addition to taking sustainability risks into account, there are additional requirements for the promotion of environmental and/or social characteristics and a stipulation that only investee companies that follow good governance practices may be selected. The disclosure must focus on explaining the environmental and/or social characteristics and whether a reference index is used. If the latter is the case, additional information on the index must also be provided. NN IP’s methodology for Article 8 includes requirements such as embedding environmental, social and governance characteristics into every investment decision, using “sustainable” in the name of a fund and setting good governance requirements for investee companies.

Article 9 of SFDR once again raises the bar. It focuses on sustainable investments as the specific objective of the fund. What constitutes a sustainable investment is defined in SFDR. The disclosure requirements of Article 9 are also linked to the index, if one is used. At NN IP, our methodology is stricter too. For example, our Article 9 funds have stricter requirements in terms of their positive contribution to sustainable development and regarding good governance through our controversy scoring system.

4. Is there a definition of “sustainable objectives” – and can these be both qualitative and quantitative?

SFDR does not include a definition of what actually constitutes a sustainable objective. But there is a high-level definition of sustainable investment: an investment in an economic activity that contributes to an environmental or social objective. It is important to note that the term sustainable objective relates to Article 9 financial products. In this context, its aim is to ensure that the investments have a clear link to sustainability, either via the individual investments or the product as a whole. Our NN IP interpretation of the requirements means that the sustainable objective can be qualitative and/or quantitative.

5. Can a portfolio be classified as Article 8 if not all the underlying investments fulfil the criteria?

In our view, the classification is more about the environmental and social characteristics that are promoted at portfolio level and the investment decision-making process to select the underlying securities. So in that sense a portfolio can be classified as Article 8 even if not all the underlying investments fulfil the criteria. Another consideration here is not wanting to exclude entities that are working hard to comply but are not there yet. Hence, it is about the extent to which environmental and social factors form part of the assessment and selection process and the role these factors play in constructing the portfolio. For government bonds, for example, one can argue that the ranking of a country on indicators such as health, education or having ecological policies are social and environmental characteristics which can be incorporated into an asset manager’s investment process.

6. How can you classify products by 10 March if the RTS was only published at the beginning of February?

Although the RTS was published less than two months before the SFDR Level 1 is set to be implemented, this is not an issue. This is because its more detailed requirements in terms of level of detail and disclosure do not have to be met before Level 1 is implemented. The outline of what is required for Level 1 was published at the end of 2019 and this what financial market participants and advisors have been working towards. The target for meeting the more extensive requirements of the RTS on the level of detail of some of the disclosures and additional requirements relating to the adverse impact indicators is 1 January 2022.

7. Is it true that Article 6 products do not have to give information on EU Taxonomy alignment while Article 8 and 9 products do?

It is true that Article 6 products are not required to show alignment with the EU Taxonomy but that it does include requirements for Article 8 and 9 products. These include, for example, the applicability of the “do no significant harm” principle to investments that take into account the EU criteria for environmentally sustainable economic activities. In terms of timelines, we do not think that the requirements for Article 8 and 9 products will need to be fully aligned with the EU Taxonomy when the SFDR Level 1 comes into effect on 10 March 2021, as the EU Taxonomy only enters into force on 1 January 2022. Accordingly, the EU Taxonomy eligibility criteria and degree of alignment can be added at a later stage.

8. What exactly is the European Single Access Point?

The European Single Access Point (ESAP) is one of the actions identified by the European Commission in its Capital Markets Union Action Plan. In this plan, the European Commission outlines the need for an EU-wide platform that provides investors with seamless access to financial and sustainability-related company information. Because of the heavy reliance on data resulting from the various sustainable finance legislative developments such as SFDR and the EU Taxonomy Regulation, the ESAP is something that could become increasingly useful and important. Discussions on this topic are currently underway, but we believe it may be some time before it is up and running. This means that entities need to ensure they have other data sources to fulfil the requirements for SFDR and the Taxonomy in 2021 and 2022.

9. What additional regulations should be mapped/cross-referenced to fully understand the data landscape?

Within the sustainable finance landscape in the EU, there are a number of regulations that lay down requirements for data. In addition to SFDR, these include the EU Taxonomy (as a classification/dictionary of economic activities that are eligible for alignment and the screening criteria to determine the degree of alignment) and the Non-financial Reporting Directive (NFRD), which is currently under review. These regulations all require, for example, that data should be reliable, readily available, granular and comparable.

In addition to the above-mentioned regulations, there are also other initiatives like the EU Green Bond Standard and the EU EcoLabel that may result in data requirements. Additionally, within the EU there are ongoing discussions between the financial industry and regulators about the need for legislation on data as a whole. The parties involved are looking into the need to regulate ESG data providers, for example, by amending the CRA Regulation (Credit Rating Agency Regulation) or via a stand-alone regulation, in addition to the European Single Access Point. There are also international initiatives such as the IFRS Global ESG Reporting Standards that may influence the approach in the EU as well.

10. How does this regulation impact investments in funds/companies outside Europe?

SFDR is expected to have some impact on asset managers based outside the EU and their local representatives in a number of instances. These relate, for example, to non-EU financial products that are marketed in the EU or when an EU-based asset manager delegates certain activities such as portfolio management or investment advisory services to an asset manager based outside the EU. Although this is not specified in SFDR Level 1, it is what the market expects based on the EC’s statements regarding the extraterritoriality of the Taxonomy Regulation. At the beginning of 2021, the ESAs also requested the European Commission to provide more clarity on the extraterritorial scope of SFDR.

Watch the recording of our webinar on SFDR

What impact will SFDR have on our industry? Are we ready for the challenges it brings? Is SFDR only a headache, or might it also create opportunities? Adrie Heinsbroek, Judith Boom and experts from PwC shared their insights about the SFDR’s implications for investors like you. Register and get access

Adrie Heinsbroek, Chief Sustainability officer at NN Investment Partners